As an Advisor, I frequently get asked this question. And ultimately, it’s a very open ended question that has all sorts of moving parts.

Most of us have never learned about how life insurance works, what the different types are, or how much it costs. But don’t worry, it’s not your fault! Many people, including myself, didn’t know these things at first.

The first thing that you should know is that any successful financial plan should start with a needs analysis. A financial needs analysis is key to finding out how much life insurance your family will need, what type you need, and what you and your family can afford. It includes things such as: date of birth, salary, debt, smoking status, spousal information, children information, investments, and goals (both short and long term).

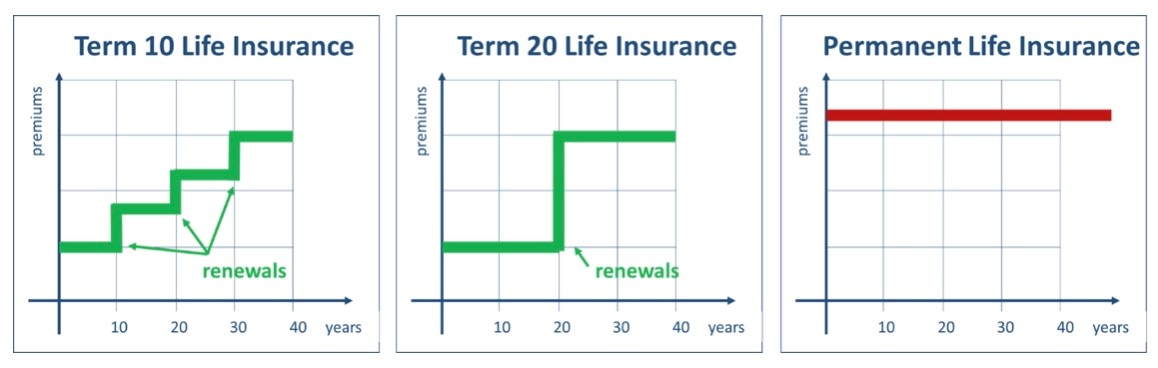

Once the needs analysis is complete, we can then determine what type of insurance you will need: Term Life, Permanent Life, or a combination of both.

Term Life Insurance:

As I mentioned in a previous blog, Term Life Insurance is great to replace debt and income. It lasts for a set amount of time (10 years, 20 years, 30 years, etc.), and is less expensive than Permanent Life Insurance. Use it for paying off a mortgages, vehicles, loans, or supporting your family during your working years.

Permanent Life Insurance

While Term Insurance will eventually run out, a Permanent Life Insurance policy is there until we die. It’s usually more costly, but serves to help pay for final expenses (funerals), leave money to family members, and it can also offset taxes upon death (yes, we have to file a tax return in our final year of life!).

Note: There are a few different types of Permanent Life Insurance. Universal Life and Whole Life Insurance are ones you may come across in your research. I strongly recommend you sit down and discuss your options with an advisor to see which best fits your family.

Combination Strategy

I recommend a lot of clients to combine Permanent Insurance and Term Insurance into one contract right from the start. It provides the best of both worlds now while reducing costs for later.

There are a lot more moving parts to life insurance than we tend to think. I strongly recommend that you meet with a qualified, respected insurance professional to decide what works best for you and your family.

If you’re not currently with an advisor and want a second opinion, please don’t hesitate to touch base with us at Harbour Financial Group.